The combination of India’s biggest tax change in years and the festive Diwali season gives real estate buyers and investors a rare chance to save money and invest smartly. With GST Reform 2025 starting on September 22, 2025, new rules and festive demand come together perfectly.

Why This is a Perfect Time

GST Reform 2025 (also called Next-Gen GST or GST 2.0) is the biggest update to India’s tax system since 2017. Diwali is also the time when most people buy homes and land

This gives two advantages:

- Lower taxes on construction materials

- High market demand during the festive season

The new GST system has just two main rates – 5% and 18%, making it simpler. Many building materials now cost less, so property prices may drop or stay more affordable during Diwali.

How GST Reform 2025 Changes Real Estate

Simpler Tax Structure in GST Reform 2025:

- Old system: 4 rates (5%, 12%, 18%, 28%)

- New system: 2 main rates (5% and 18%)

- Luxury items: 40%

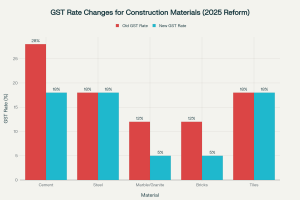

Material Cost Cuts in GST Reform 2025:

- Cement: 28% → 18% (saves 10%)

- Marble & Granite: 12% → 5%

- Fly Ash Bricks: 12% → 5%

- Building Stones & Blocks: now 5%

Property GST Rules Remain Mostly the Same in GST Reform 2025:

- Affordable housing (under construction): 1% GST, no tax credit

- Non-affordable housing (under construction): 5% GST, no tax credit

- Commercial properties: 12% GST, with tax credit

- Ready-to-move properties: No GST

How Prices Can Be Affected

Experts say construction costs may drop 3–5% because of cheaper materials. This can make buying property more affordable.

Market Predictions:

- Property prices may rise 6.3% in 2025 and 7% in 2026, but GST cuts help keep increases manageable.

CBRE expert Anshuman Magazine explains:

“Cement, steel, and other building materials make up 40–45% of construction costs. Lower GST means lower project costs, which helps buyers save.”

Who Benefits Most

- Affordable Housing: Gains the most because small cost changes matter a lot.

- Mid-Segment Housing: Costs drop, making homes easier to buy.

- Luxury Housing: Moderate benefit, improves project viability.

- Commercial Real Estate: Mixed effect, but cheaper materials still help.

✅ In short: GST Reform 2025 + Diwali demand = the best time in years to invest in property in India.

Investment Strategies for Diwali

Diwali is the best time to invest because sales usually jump 15–25%, and developers offer special festive deals.

Smart Tips for Investors:

- Timing

- Invest in Lands or under-construction projects launching around Diwali to get GST savings + festive discounts.

- Deals may include waived registration fees, gold coins, and flexible payment plans.

- Segment Focus

- Focus on affordable, mid-segment housing and Land.

- ANAROCK data shows affordable housing supply dropped from 38% in 2019 to 18% in 2024, creating opportunities.

- Location Strategy

- Look at Tier-2 cities and emerging corridors where infrastructure is growing and prices are lower.

- Diwali demand rises as professionals seek larger homes with work-from-home options.

- Financing Leverage

- Use Diwali loan offers: lower fees and faster approvals.

- Interest rates in the high-7% range make borrowing attractive.

- Developer Selection

- Choose reliable developers likely to pass GST savings to buyers.

- CREDAI Chairman Boman Irani notes that GST cuts (GST Reform 2025) have created positive buyer sentiment, showing developers are committed to sharing benefits.

- Looking ahead, GST Reform 2025 is set to bring greater transparency to property deals and boost buyer trust. By lowering hidden costs, GST Reform 2025 helps create smoother transactions between developers and investors. Many experts believe GST Reform 2025 will also attract global investors by ensuring a stable and clear tax structure. At the same time, GST Reform 2025 is aligning India’s real estate market with international standards. At Big International Real Estate, we see GST Reform 2025 as a strong driver of long-term growth, giving our clients the confidence to invest at the right time.

For expert real estate investment guidance and property solutions, contact Big International Real Estate at +91 965-111-1114. Our team helps clients navigate the market and make smart property decisions.