Introduction: The Seismic Transformation in India’s Real Estate Market

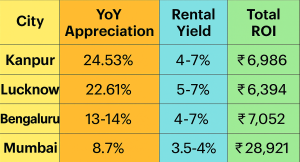

The Indian real estate landscape is experiencing an unprecedented real estate shift 2025 that challenges decades of conventional investment wisdom. Tier-2 cities like Lucknow and Kanpur are now delivering superior returns compared to metropolitan powerhouses Mumbai and Bengaluru. The evidence is compelling: Kanpur is delivering 24.53% year-on-year capital appreciation while Mumbai achieves just 8.7%. Lucknow’s 22.61% growth significantly outpaces Bengaluru’s 13-14%.

What Is Driving the Real Estate Shift 2025?

The Metro Affordability Crisis

Mumbai and Bengaluru have priced out their core demographic. In Mumbai, apartments above ₹1 crore account for 62% of sales, while properties under ₹40 lakh collapsed from 37% (2021) to just 18% (2025). Bengaluru experiences 20-25% drop in buyer enquiries across IT corridors, with 62,000+ tech job losses paralyzing younger professionals who historically drove demand.

Simultaneously, housing sales across India’s top 7 cities fell 12% year-on-year in Jan-Sep 2025, yet prices rose 11%—indicating market dysfunction. 76% of metro buyers are now stretched on EMIs, signaling the affordability crisis has reached critical levels.

Infrastructure Investment Boom in Tier-2 Cities

The real estate shift 2025 becomes irreversible with transformative infrastructure:

-

Lucknow-Kanpur Expressway: ₹4,700 crore, completing December 2025, reducing travel time from 2+ hours to 40 minutes

-

Lucknow-Kanpur Rapid Rail: 67 km high-speed corridor reducing travel to 40 minutes, integrating with metro networks

-

Lucknow Metro Expansion: ₹5,801 crore East-West Corridor approved August 2025

-

UP Defence Industrial Corridor: ₹20,000 crore with Kanpur as highest-investment node (₹1,700 crore allocated)

-

Industrial & Commercial Zones: 300 sq km industrial corridor across Lucknow-Unnao-Kanpur

The ROI Reality: Why the Real Estate Shift 2025 Matters

Capital Appreciation vs Total Returns

An investor deploying ₹50 lakh in Mumbai sees it grow to ₹56-56.5 lakh annually. The same investment in Lucknow reaches ₹61-65 lakh—a ₹4-9 lakh advantage yearly.

Affordability Advantage

Real Estate Shift 2025 fundamentally hinges on accessibility:

-

Mumbai: 2-3 BHK apartments cost ₹1.5-3 crore

-

Bengaluru: 2-3 BHK apartments cost ₹80-120 lakh

-

Lucknow: 2-3 BHK apartments cost ₹40-90 lakh (accessible to first-time buyers)

-

Kanpur: 2BHK from ₹15-45 lakh, 3BHK from ₹25-70 lakh

First-time buyers priced out of metros find immediate entry in Lucknow/Kanpur with 20-25% down payments (₹6-12 lakh).

Investment Performance in Lucknow & Kanpur

Lucknow’s Explosive Q1 2025 Performance

-

₹1,797 crore sales value (+48% jump)

-

1,301 residential units sold (+25% increase)

-

Highest growth among Tier-2 cities while broader Tier-2 market declined 8%

Locality Performance:

-

Gomti Nagar Extension: 15-20% annual appreciation, 77.2% growth (2021-2025)

-

Mahanagar: 119.4% increase (March 2019-2024)

-

Gomti Nagar: 88.6% increase (March 2019-2024)

Kanpur’s Infrastructure Pipeline

-

Over 100 development projects underway

-

₹9,400 crore Outer Ring Road (operational 2027)

-

₹8,000 crore leather cluster; software technology park, footwear park

-

₹23,086 crore bridge infrastructure plan (49 new bridges/flyovers)

When infrastructure completes, property values surge—this is the real estate shift 2025 in motion.

Strategic Investment Recommendations

For First-Time Homebuyers

Target: Emerging areas offering ₹30-50 lakh 2-3 BHK apartments

Lucknow Localities: Sultanpur Road, Gomti Nagar Extension, Sarsaul

Kanpur Localities: Rooma, Civil Lines, Swaroop Nagar, Kakadeo

Strategy: Purchase near schools, markets, and expressway corridors with 20-25% down payments. Expected 22-24% annual appreciation while building equity. Purchase within 6 months before expressway opening; post-opening, prices will surge 20-40%.

For Value & HNI Investors

Target: Premium gated communities in ₹1-3 crore range

Strategy: With 26% of NRI buyers targeting properties above ₹1 crore, luxury segments offer capital appreciation + rental income. Expected ROI: 12-15% annually in prime locations.

Timeline: 3-5 year hold period captures infrastructure completion upside.

For Commercial Real Estate Investors

Target: Commercial plots and retail spaces along expressway/rapid rail corridors

Opportunity: Industrial land in Lucknow-Kanpur Industrial Corridor appreciating 15-20% annually as manufacturing and logistics operators establish operations.

Expected ROI: 18-22% annually post-infrastructure completion.

Risks & Counterarguments

Are Bubbles Forming?

Evidence Against Bubble Concerns:

-

Fundamentals Strong: ₹50,000 crore infrastructure creates genuine demand; jobs being created in defense manufacturing, IT services, logistics

-

Affordability Intact: Even post-appreciation, Lucknow at ₹8,000-10,000 psf remains affordable vs metros at ₹25,000-30,000 psf

-

Sales Volumes Rising: Lucknow Q1 2025 (+25% YoY) shows end-user absorption, not speculation

-

Developer Confidence Genuine: Long-term capacity expansion by reputable developers

Genuine Risks:

-

Infrastructure delays beyond 2026 could stall momentum

-

If employment generation lags, demand could plateau

-

Macro headwinds (recession, rate spikes) could constrain financing

-

Developer over-building could create inventory overhang

Verdict: The real estate shift 2025 is a structural reallocation, not a bubble. Risks exist but are manageable with diversification and long-term horizon.

The Timeline of the Real Estate Shift 2025

-

October-December 2025: Lucknow-Kanpur Expressway completion; immediate corridor property surge (+20-40%)

-

2026: Lucknow Metro operational; UP Defence Corridor manufacturing begins

-

2027: Kanpur Outer Ring Road completion; commercial real estate surge

-

2028+: Rapid Rail operational; second-order appreciation wave

Smart investors are capturing early appreciation now before infrastructure completion. By 2028, this window closes.

Conclusion

The Real Estate Shift 2025 is redefining India’s property market — and cities like Lucknow and Kanpur are leading the way.

If you’re aiming for 22–32% ROI backed by real infrastructure growth, now is the time to act.

BIG International Real Estate helps investors secure the right land at the right time — before prices surge.

📞 Connect today: +91 965-111-1114